Achieving positive net income is a goal that most companies and small business owners aim to reach. But some startups and hypergrowth companies operate at a loss for several years as they invest heavily to capture market share in their niche.

This guide covers the basics of net income and how to calculate it. Our focus is business net income, although net income and net worth may also apply to personal finance.

Table of Contents

- What is Net Income?

- Net Income in Business

- How to Calculate Net Income

- Example of Net Income

- The Role of Net Income in Financial Statements

- Net Income FAQs

- Is net income your salary?

- Can net income be negative?

- What is net income vs gross income?

- What is net income vs cash flow?

- Is EBIT the same as net income?

- The Importance of Net Income to Your Business

What is Net Income?

Net income (profit after taxes or net profit) is the residual amount on an income statement after subtracting costs and expenses from net revenues for the accounting period. The costs and expenses to subtract from revenues are cost of goods sold, categorized operating expenses, net interest expense and any other non-operating expenses, and income taxes.

Net Income in Business

In businesses, important net income considerations are:

- Accounting method

- Basic vs. multi-step income statement

- Ways to categorize business expenses

- EPS and earnings presentations

Accounting Method

Net income in business requires deciding on an accounting method. GAAP (generally accepted accounting principles) requires accrual accounting rather than cash basis accounting.

Some small business taxpayers without inventory qualify to use the cash method of accounting instead of accrual accounting to compute net income on their tax returns. They can choose the same cash method for business financial statements to maintain only one set of books. The IRS sets the rules for allowing cash method accounting for income taxes. Ask your CPA firm to determine the right accounting method for your company.

Calculating net income in business with accrual accounting requires proper revenue recognition, matching revenue and expenses in the same accounting period, and considering non-cash expenses like equipment depreciation and amortization of intangible assets.

Multi-step income statement

In businesses using a multi step income statement, gross profit less cost of goods sold (COGS) is calculated, with a financial statement subtotal line of gross profit before operating expenses are subtracted.

Ways to Categorize Business Expenses

Categorized operating expenses include selling, general, and administrative expenses (SG&A), research & development (R&D), and any other categories of expenses relating to their business operations. In this case, marketing expenses are included in the SG&A line item. Some companies disclose general & administrative expenses (G&A) as a separate line item within the operating expenses section of their income statement.

For internal financial analysis, management accountants in businesses may further classify expenses into fixed vs variable categories to calculate their contribution margin, variable expense ratio, and breakeven point. Variable costs are direct costs that vary with the volume level.

Splitting expenses into variable expenses and fixed expenses is useful for product pricing, determining whether to accept certain orders at a lower price, and performing breakeven analysis.

EPS and Earnings Presentations

Businesses may also present basic and diluted earnings per share (EPS) on their income statement, using net income as the earnings amount.

Public companies often disclose GAAP earnings and non-GAAP earnings that are reconciled to net income per the GAAP financial statements in their SEC Company Filings and press releases for quarterly and annual financial statements.

How to Calculate Net Income

When deciding how to calculate net income, you can use different net income formulas, depending on whether you’re interested in a basic or multi-step formula.

Basic Net Income Formula

Net Income = Revenue – Total Expenses

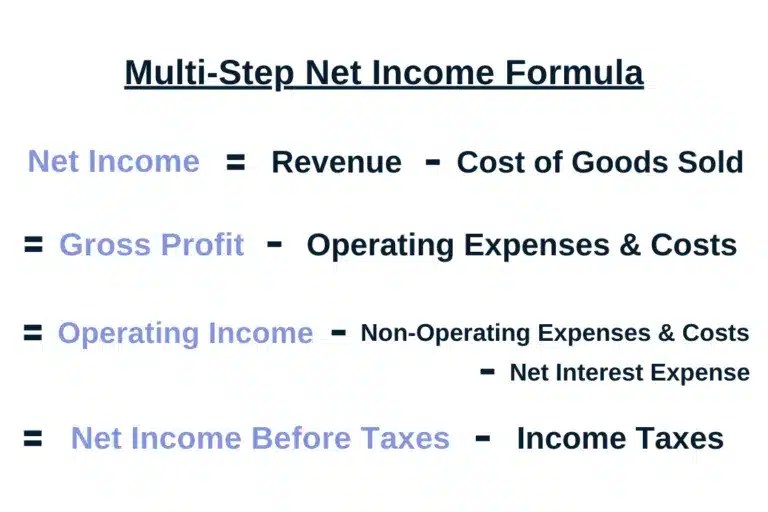

Multi-step Net Income Formula

Net Income = Revenue – Cost of Goods Sold = Gross Profit – Operating Expenses and Costs = Operating Income – Non-operating Expenses and Costs – Net Interest Expense = Net Income Before Taxes – Income Taxes

Another name for the subtotal operating income is operating profit, which measures a company’s profitability from operating activities. Net interest expense is one type of non-operating expense, but it’s listed as a line item in a multi-step financial statement.

The net income calculation can be broken down into 5 separate net income formulas used in a multi step income statement, as shown in this linked Tipalti article.

Transform the way

your finance team works.

Bring scale and efficiency to your business with fully-automated, end-to-end payables.

Read more

Example of Net Income

For our net income example, the following annual financial results for Exampt Inc. (not a real company) are assumptions to calculate its net income. We’ll use a multi-step income statement approach, reflecting the multi-step net income formula.

| Assumptions for Calculating Exampt Inc.’s Net Income | Amounts in Dollars |

| Net sales revenue | $20,000,000 |

| Net service revenue | 6,000,000 |

| Cost of goods sold | 16,000,000 |

| SG&A expenses | 4,000,000 |

| R&D expenses | 1,500,000 |

| Other operating expenses | 400,000 |

| Other non-operating expenses | 800,000 |

| Net interest (income) expense | 250,000 |

| Income tax expense | 600,000 |

Net Income Calculation as Multi-Step Income Statement:

| Net sales revenue | $20,000,000 |

| Net service revenue | 6,000,000 |

| Total Revenues | $26,000,000 |

| Less: Cost of Goods Sold | 16,000,000 |

| Gross Profit | $10,000,000 |

| Operating Expenses: | |

| SG&A expenses | 4,000,000 |

| R&D expenses | 1,500,000 |

| Other operating expenses | 400,000 |

| Total Operating Expenses | $5,900,000 |

| Total Operating Income | $4,100,000 |

| Other non-operating expenses | 800,000 |

| Net interest (income) expense | 250,000 |

| Net income Before Taxes | $3,050,000 |

| Income tax expense | 600,000 |

| Net Income | $2,450,000 |

In this example, net income is calculated as $2,450,000. The net profit margin metric, which divides net income (net profit) by total revenues on the company’s income statement is 9.4%.

The Role of Net Income in Financial Statements

Net income has a role in financial statements. On the income statement, net income is revenue minus costs and expenses (including income taxes) which equals profit (or loss if negative). Net income is a component in the calculation of retained earnings in shareholders’ equity on the balance sheet. On a cash flow statement, net income is reconciled to cash flow from operating activities.

Net Income FAQs

Frequently asked questions with answers about net income follow.

Is net income your salary?

Net income isn’t the same as your salary. For individuals, your salary is a source of income disclosed on a personal financial statement and a component of your gross income on a tax return.

Can net income be negative?

Yes. If the calculation of net income is a negative amount, it’s called a net loss. The net loss may be shown on an income statement (profit and loss statement) with a minus sign or shown in parentheses. A company with positive net income is more likely to have financial health than a company with negative net income.

What is net income vs gross income?

Net income is gross income minus costs and expenses. On a business financial statement, gross income is equivalent to revenues. For an employed individual, gross income includes different sources of income, including:

- Wages or salaries, bonuses, and sales commissions earned before payroll deductions

- Investment income

- Real estate rents received by a landlord

- Other miscellaneous income

For an independent contractor, gross income includes the amount of money for client revenue that’s paid to them in a calendar year and reported on a payer’s 1099 form that relates to their submitted W-9 form.

Gross income also includes revenue from other customers below the $600 minimum of a 1099 form. When expenses and costs are subtracted from these revenues, the independent contractor can produce financial statements showing a bottom line for net income.

What is net income vs cash flow?

Net income in accrual accounting is different than cash flow. An indirect cash flow statement reconciles net income with cash flow from operations by adding back non-cash items, including depreciation and amortization and changes in account balances for different types of working capital during the accounting period.

Working capital balance changes, such as an increase in the accounts receivable balance or a decrease in the accounts payable balance, require subtractions rather than additions in this reconciliation of net income to cash flow from operations. Working capital balance changes reflect increases or decreases in the use of cash by a business.

Is EBIT the same as net income?

No. EBIT is earnings before interest and taxes. Net income is earnings after interest and taxes. Therefore, EBIT is not the last line of the income statement, as is net income. As a variation of EBIT, EBITDA is earnings before interest, taxes, depreciation, and amortization. Net income vs EBITDA is different.

The Importance of Net Income to Your Business

Net income is important to businesses because profitability drives business success. With net income, businesses can reward their stakeholders, including employees earning bonuses and stockholders. With sufficient net earnings, larger public companies can continue to pay dividends.

The amount of revenue and operational efficiency are key factors in determining net income. A company’s net income is positive when revenues are sufficient to cover costs and expenses, including interest and taxes.

Although net income may result in positive cash flows, fast growth can result in negative cash flows if the cash generated from operations is tied up in higher inventories to fuel future growth. Therefore, it makes sense to track both net income and cash flow.

If a company has net income, it may be approved for lines of credit or bank loan financing that will sustain business operations and growth.